Hello, in this post we will discuss the TDS return forms with the explanation of each form which you can understand better.

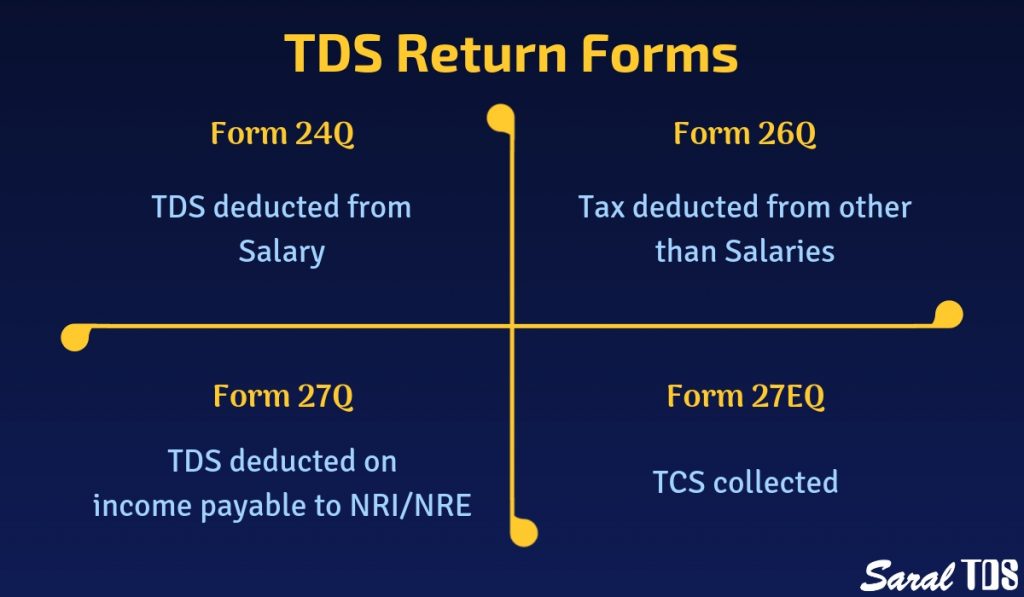

It is important to note that there are various types of TDS return forms for different scenarios of deducting TDS. Below are the forms based on the Nature of income of the deductee.

| Type of form | Particulars of TDS forms |

|---|---|

| Form 24Q | TDS deducted from Salary |

| Form 26Q | Tax deducted from other than salaries |

| Form 27Q | TDS deducted on income payable to NRI/NRE |

| Form 27EQ | TCS collected |

Now, we will explain each form in detail to make it easy for you to understand

Form 24Q

- This form is used for preparing TDS returns for the TDS on salary u/s 192 of Income Tax Act.

- The form details are based on the employees’ salary payments and Tax deducted by employers.

- You need to submit this form on a quarterly basis.

- You can submit this form online along with the required documents as well as submit it in electronic mode at TINFC.

- This form contains 2 Annexures. They are:

- Annexure-I – Details of tax deducted and paid in all four quarters.

- Annexure-II – Details of salary and deductions considered for tax calculation which has to be submitted in the fourth quarter.

Form 26Q

- You need to submit this form based on Tax deducted on payments other than salary made to resident Indians.

- It is applicable under section 200(3), of the Income Tax Act of 1961.

- The income on which the TDS deducted includes interest on securities, dividend securities, professional fees etc.

Form 27Q

- This form is applicable for other than salary payments made to non-resident Indians and foreigners.

- The income on which TDS is deducted includes interest, bonus, if any additional income or any other amount owed to non-resident Indian or foreigner.

- This is a quarterly deduction by the deductor and is applicable under section 200(3) of the Income Tax Act of 1961.

- The tax will be deducted on the payment made depending on the DTAA Act or IT Act as applicable for the respective deductee country.

- This return will consist of the details of Form 15 CB as provided by the CA for foreign remittance (if applicable)

Form 27EQ

- Tax Collected at Source (TCS) is a tax collected by the seller from the buyer of certain goods. When the buyer purchases some goods the seller collects the tax from the buyer through the TCS route. The tax is collected in the form of cash, credit or cheque or any other mode of payment

- This form is a quarterly statement which furnishes the details of TCS u/s 206C of the Income Tax Act.

- It is compulsory to mention TAN in this form.

- Form 27EQ is submitted on a quarterly basis.

This ends the post on TDS return forms. Let us know your opinion by commenting below.

Returns the TDS amount

My account