Hello. In this post, we will continue to see the different types of MIS reports under Form 26Q in Saral TDS.

This post will state on below reports:

• Short/Excess Deduction

• TDS Extract for ITR

• ePayment Extract

• Form 3CD 34 [(a),(b),(c)]

• 15G/15H UIN Report

• UIN not used in TDS

To read on the types of reports, click on the link below:

https://www.saraltds.com/tutorials/mis-reports-in-form-26q/

Let us continue with the reports.

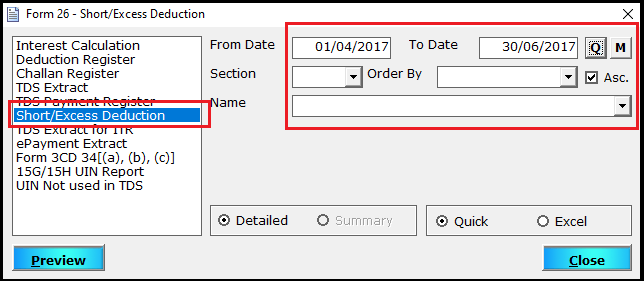

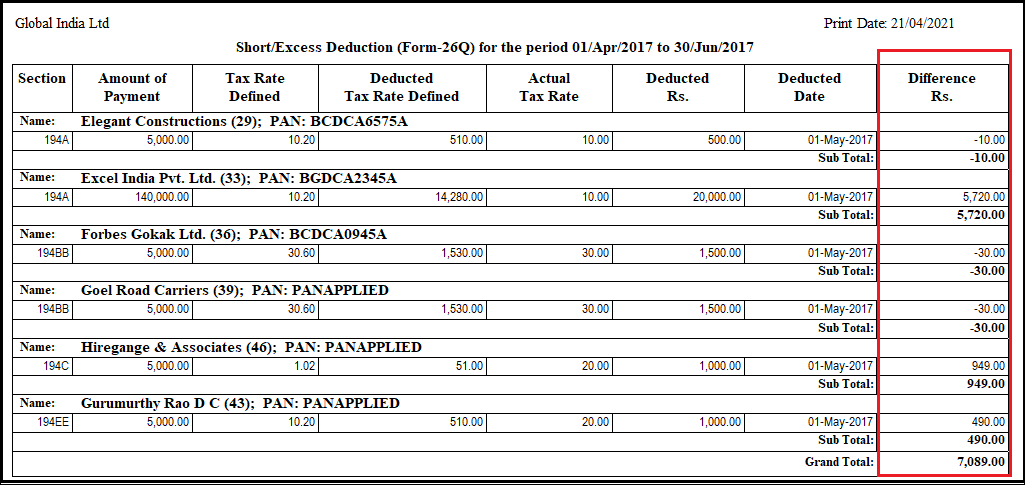

The next report is Short/Excess Deduction. This can be generated to view the deductions which are made in short or excess.

To generate the report, click on Short/Excess Deduction and enter the related details like period of deduction, section of deduction, and others.

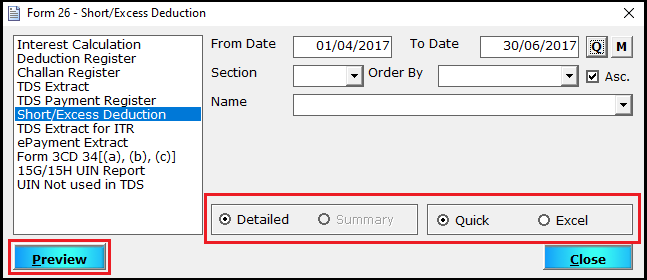

Now, select the type of report required and click on Preview.

The required report with the difference amount i.e. amount in short or excess deducted will be displayed.

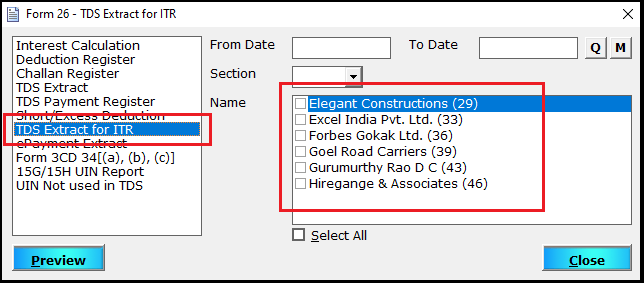

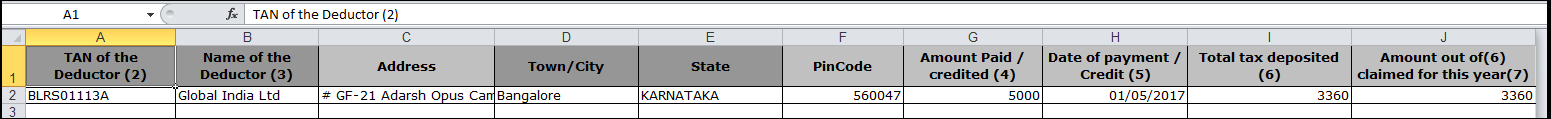

Next report is the TDS Extract for ITR. This report will provide the required details of the deductee for ITR filing.

Select TDS Extract for ITR select the deductee for whom the report is to be generated.

On click of Preview, excel report for each of the deductee selected will be generated.

This excel report will contain the details of the TDS deducted for the respective deductee.

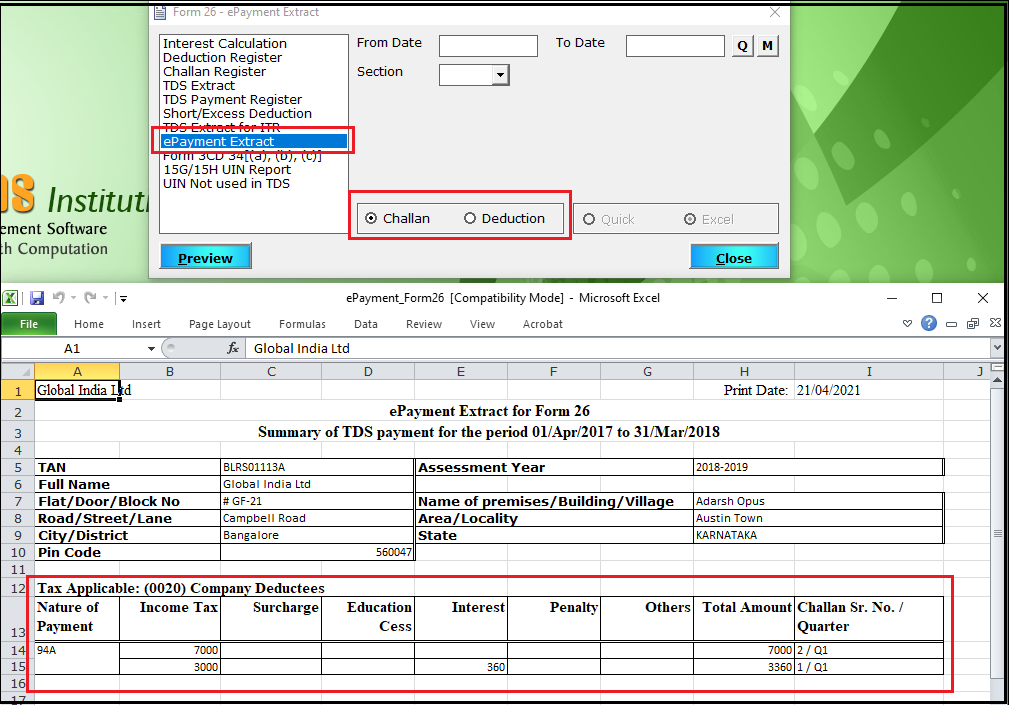

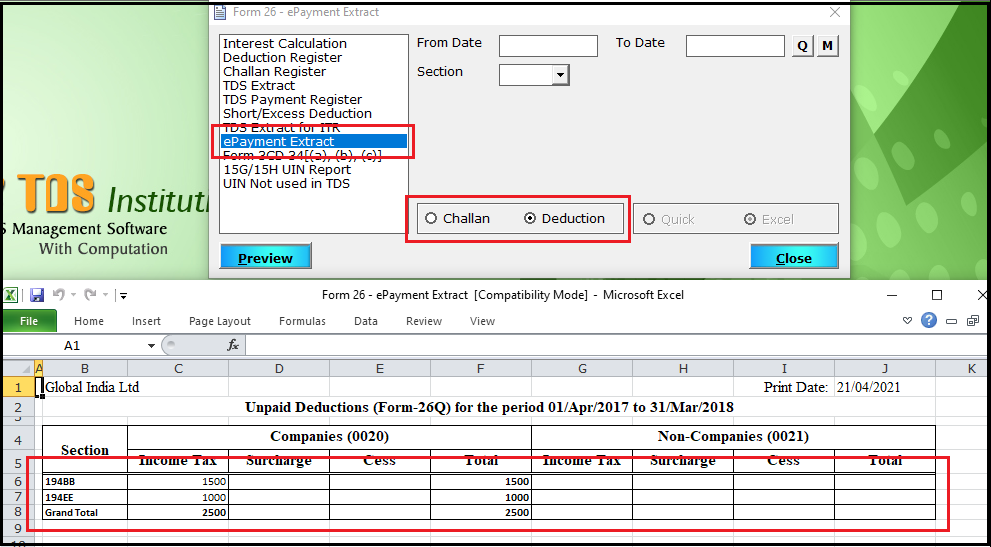

The ePayment Extract report can be generated in two ways.

The first report is for Challan where the challan paid through epay mode will be listed. Select ePayment Extract and click on Challan. The Preview will display the challans paid online.

The other report, when selected deduction, will display the deduction amount which is yet to be paid.

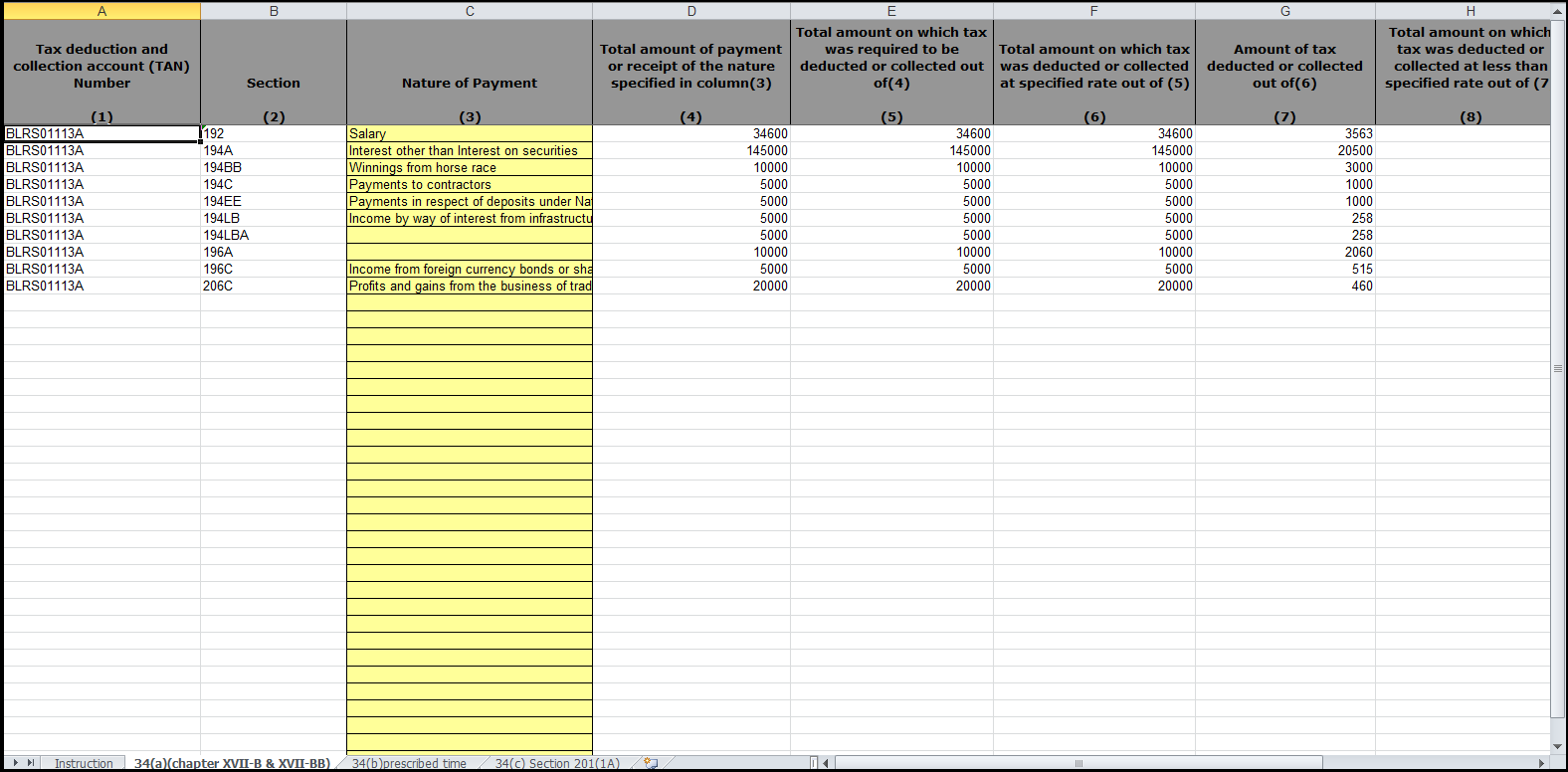

The report Form 3CD 34 [(a),(b),(c)] will provide the required details for Audit report preparation. The report will be made available in Excel.

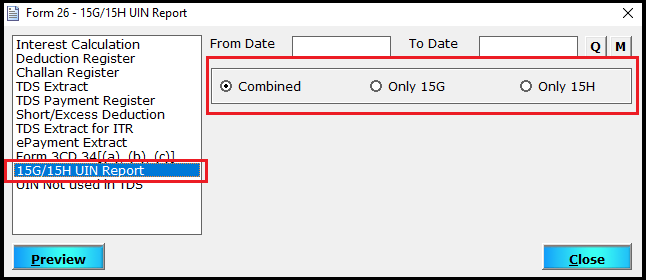

15G/15H UIN Report will provide the details of all the deductions where UIN is allocated for Form 15G/15H submitted.

Select 15G/15H UIN Report and click on the type of report required i.e. Combined to have a single report on both 15G and 15H details, Only 15G to have a report only on From 15G details and Only 15H to have a report only on Form 15H details.

Note: For Form 15H, the details can be filtered based on the DOB of the individual.

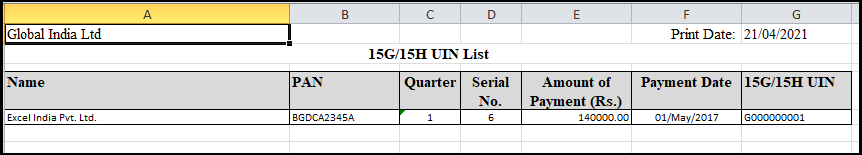

The report will be made available in an excel sheet.

The last report is UIN not used in TDS. This report is generated when any UIN detail is entered in the Form 15G/15H module but the same has no deduction record in quarterly TDS return filing.

This completes MIS reports under Form 26Q of Saral TDS.